Best cost basis method for crypto taxes (2026)

Jan 27, 2026・6 min read

When someone sells, swaps, or spends crypto in the United States, it triggers a taxable capital gain (or loss). Although each person’s tax rate depends on their income and how long they held their crypto, the first step to answering this question is always the same: Determine the cryptocurrency’s cost basis for the unit(s) disposed of.

Knowing your crypto’s cost basis is essential because it represents what you paid for specific units of cryptocurrency for tax purposes. Without this, you can’t accurately calculate your capital gains or losses. Your cost basis method determines which crypto is treated as sold first, and different cost basis methods can change this calculation.

The IRS has a default method for cost basis calculations, but that doesn’t mean taxpayers always need to use it. By specifically identifying the units at the time of the transaction and keeping clear records, you may choose a cost basis method that best suits your tax situation. Knowing how to calculate cost basis for crypto gives you more flexibility for tax planning.

In this guide, we’ll explore the best cost basis methods for crypto taxes.

What’s cost basis in crypto?

Crypto cost basis represents the amount you paid for digital assets, including acquisition costs, or their fair market value (FMV) at the time of receipt. For example, if you bought 1 ETH for $2,500 with a 0.02% exchange fee and a $5 gas fee, your cost basis would be $2,505.50. If you received 0.10 BTC as a mining reward when BTC’s FMV was $40,000 per BTC, your cost basis in that 0.10 BTC would be $4,000 (which is generally taxable as ordinary income when received).

Why your chosen cost basis method matters

Because cost basis affects the amount of taxable gain or loss and whether it’s short-term or long-term for each sale, how you calculate your cost basis determines how much you’ll pay in taxes. For example, if you sell 1 BTC today and choose to use the BTC you bought at a higher price a few months ago as your cost basis, your total taxable gain will be lower than if you used the cost basis of the BTC you bought in 2012 at a much lower price.

However, any sales of cryptocurrencies purchased less than a year ago are considered short-term capital gains, taxed at your federal income tax bracket rates. If you sell the digital assets you bought at least one year ago, you may qualify for long-term capital gains taxes at rates of 0%, 15%, or 20%, depending on your income level and filing status. So, in the BTC example above, depending on which lot you treat as sold, you might owe less tax at a higher short-term rate, or you might owe more tax at a lower long-term capital gains rate.

Overview of the main crypto cost basis methods

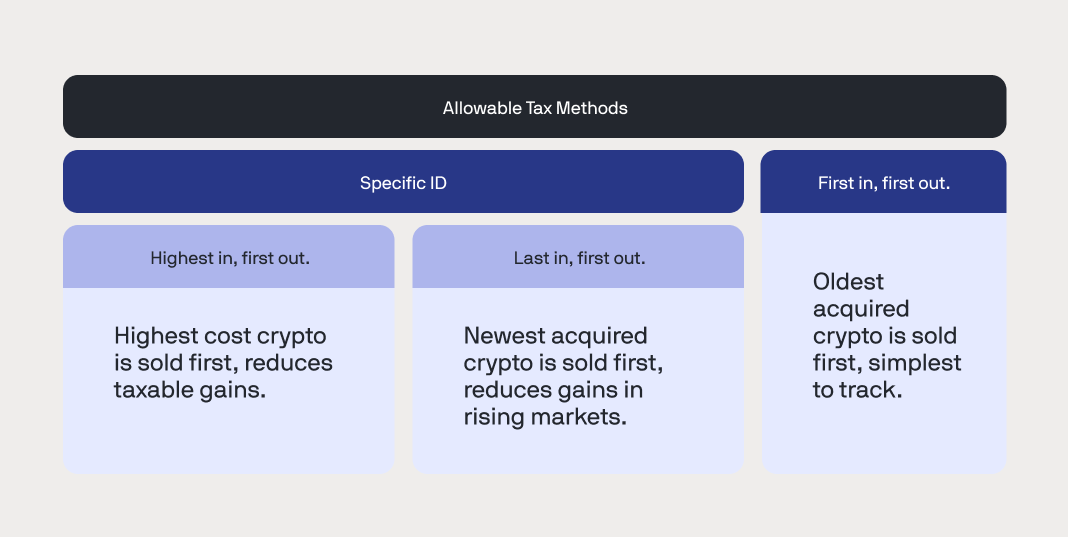

The IRS crypto cost basis rules allow taxpayers to use two methods to determine cost basis: FIFO and Spec-ID.

- First In, First Out (FIFO): This method treats the earliest acquired units as sold first.

- Specific Identification (Spec-ID): This method identifies specific units or lots disposed of. Crypto traders may use HIFO or LIFO through the Spec-ID method.

- Last In, First Out (LIFO): This Spec-ID strategy treats the most recently acquired units as sold first.

- Highest In, First Out (HIFO): This Spec-ID strategy treats units with the highest cost as sold first.

FIFO: The standard method

If you don’t specifically identify which units you sold at the time of the transaction, the IRS applies FIFO as the default identification rule to your crypto disposals, and your cost basis is calculated using your earliest crypto purchases.

FIFO is the easiest method to track, making it simpler to substantiate than more complex methods. FIFO can also help you qualify for long-term capital gains rates if your oldest lots are held for more than a year. However, since FIFO starts with the oldest lots first, it can increase taxable gains if those lots have the lowest cost basis (for example, coins bought early in a bull market).

Specific Identification for crypto: The most customizable method

Spec-ID allows investors to choose which crypto lots they want to use for each disposal. Starting January 1, 2025, taxpayers must identify the disposed asset no later than the time of the transaction. This self-directed method gives traders the freedom to use alternative strategies, such as HIFO or LIFO, or to choose crypto lots in any order.

Although Spec-ID gives you control over your capital gains and losses, it also requires extensive documentation to support your reporting. Crypto software like CoinTracker can help you organize and maintain detailed records to comply with IRS regulations.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

LIFO: A potential way to minimize gains

LIFO is a Spec-ID approach that treats your most recently acquired units as sold first, which can reduce taxable gains in rising markets if those newer units have a higher cost basis.

Starting January 1, 2025, you can only use LIFO if you select it as your accounting method before trading and maintain clear documentation.

HIFO: A strategy to minimize gains and maximize losses

HIFO is another cost basis approach under Spec-ID that lets you use your highest-price crypto units as the units you treat as sold.

Starting January 1, 2025, you can only use HIFO if you select it as your accounting method before trading and maintain clear documentation.

Although HIFO requires more meticulous record-keeping than FIFO, it’s often one of the most tax-efficient approaches for minimizing taxable gains. HIFO can also support tax-loss harvesting by prioritizing higher-basis units to help you realize losses. If you are a high-frequency or active decentralized finance (DeFi) user, and long-term capital gains are not your primary goal, HIFO could be a strong way to minimize gains from frequent transactions.

How to change your cost basis method

Taxpayers can use Spec-ID instead of the default identification rule if they identify the specific units disposed of no later than the transaction date and time and maintain contemporaneous documentation of their crypto activities.

On some centralized exchanges (CeFi), you may be able to select a supported accounting method (e.g., FIFO, LIFO, or HIFO) in your settings. For DeFi and self-custody wallets, you would generally rely on your own records or a tax software like CoinTracker to apply a method consistently. If you use both an exchange setting and CoinTracker, make sure the methods match.

Starting January 1, 2025, you can’t change your cost basis method from FIFO to Spec-ID retroactively, so make sure you’ve specified a cost basis method before trading.

CoinTracker takes the stress out of calculating crypto cost basis

Choosing and calculating crypto cost basis can involve many moving parts. To simplify this record-keeping process, CoinTracker can bring all your transaction data into a single dashboard. After linking your exchange APIs and public wallet addresses, our Portfolio Tracker will give you a real-time read on your crypto net worth, including details on every transaction and the resulting gains/losses under your selected accounting method. You can then easily import this info into IRS-compliant forms ready for a CPA, TurboTax, or H&R Block.

Want a clear view of your assets at all times? With CoinTracker, link your wallets and exchanges to monitor your portfolio’s performance in real time. Create a free account and see why crypto investors trust us.

Disclaimer: This post is informational only and is not intended as tax advice. For tax advice, please consult a tax professional.

FAQs

What’s the best cost basis method for lowering taxes?

There isn’t a “best” cost basis method because every investor has different goals. While the IRS may automatically apply FIFO in the absence of a Spec-ID selection, the best approach to FIFO versus HIFO (or LIFO) crypto cost basis methods depends on your tax needs. While HIFO lowers taxable gains most consistently, FIFO may qualify you for a lower long-term capital gains rate.

Do I have to pick one cost basis method for the entire year?

No. You don’t necessarily have to use one method for the entire year. You can use different lot-selection approaches for different disposals. As long as you keep meticulous records of your transactions and ensure you don’t use the same unit’s cost basis more than once, you can apply different cost basis methods from transaction to transaction and across years.

Does the IRS allow HIFO?

Yes. HIFO is acceptable as a lot selection strategy under Spec-ID, allowing you to treat your highest-basis units as sold first if you maintain clear records.

Can I use LIFO for crypto?

Yes. Like HIFO, you can use LIFO via Spec-ID, treating your most recently acquired units as sold first, provided you maintain adequate lot-level records.