Clarity, in time for 1099-DAs: CoinTracker’s biggest upgrade yet

Jan 20, 2026・6 min read

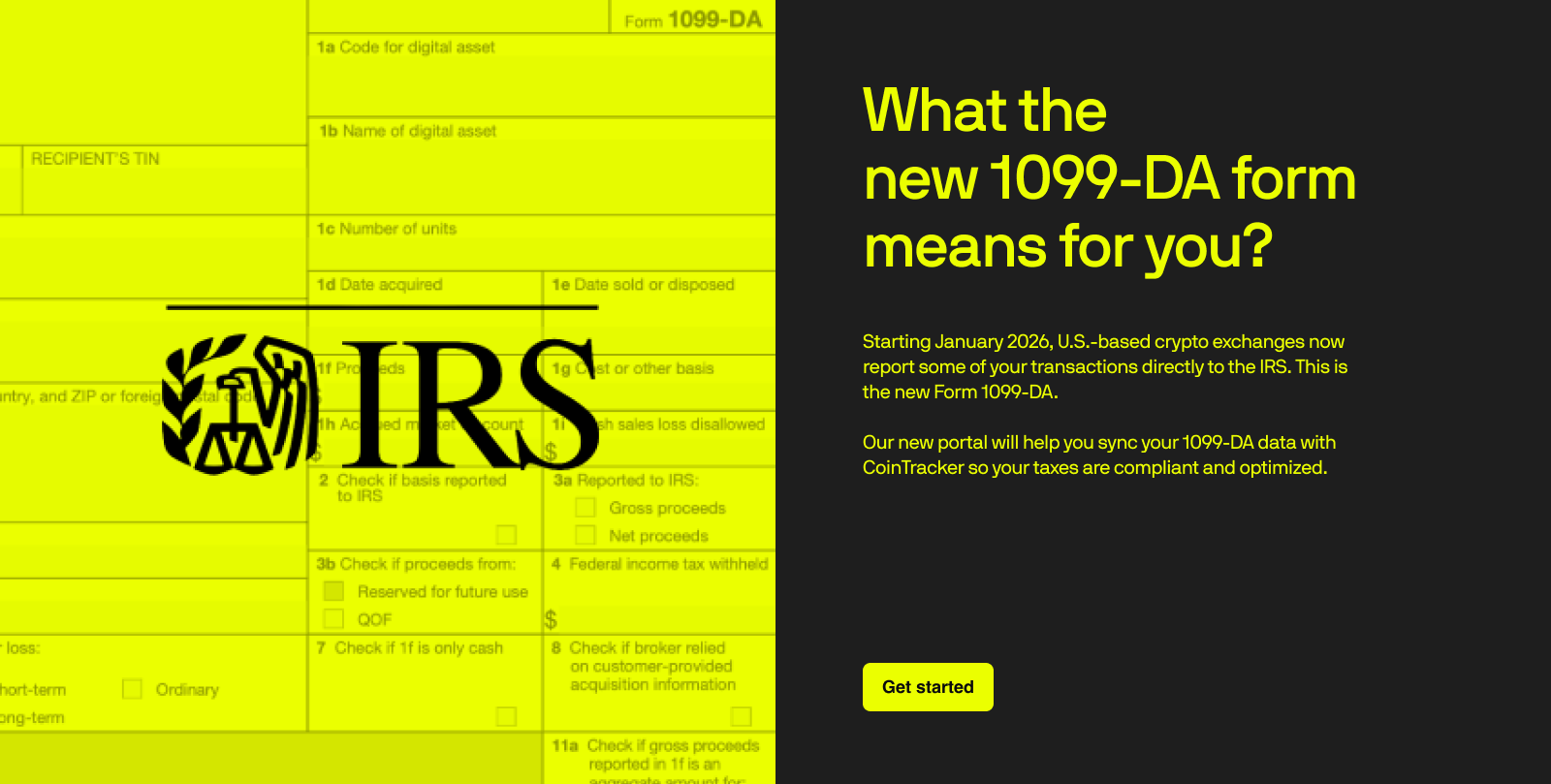

The arrival of the 1099-DA marks the biggest shift in crypto taxes to date. For the first time, millions of Americans will receive digital asset tax forms, and the IRS will know what you owe. It’s a turning point for the entire industry.

We’ve spent the past year refining every layer of CoinTracker — our infrastructure, accuracy engine, and end-to-end experience — to ensure you’re ready the moment those forms arrive. The result: a faster, smarter, and more intuitive CoinTracker that helps you make sense of it all.

As the underlying infrastructure powering 1099-DA compliance for top exchanges, tax professionals, and DIY software, we connect the entire ecosystem, minimizing your compliance risk and streamlining crypto tax filing from start to finish.

Whether you’re filing crypto taxes for the first time, or reconciling 1099-DAs against years of cost basis across wallets and chains, CoinTracker delivers institutional-grade accuracy with consumer-grade simplicity, giving you clarity, confidence, and control in a year when it matters most.

1099-DA, explained

From January 1st to February 15th 2026, crypto brokers will begin issuing 1099-DA forms to users. It’s the most significant change to crypto tax reporting in a decade, and it’s poised to create confusion for millions.

CoinTracker is the only crypto tax platform designed to support the full 1099-DA lifecycle — from ingestion to reconciliation to final filing. We help generate complete and accurate tax forms in minutes by leveraging your full transaction history to fill in gaps on 1099-DA forms from every exchange.

As forms roll out, accuracy becomes non-negotiable — and CoinTracker is built to keep you on the right side of the IRS.

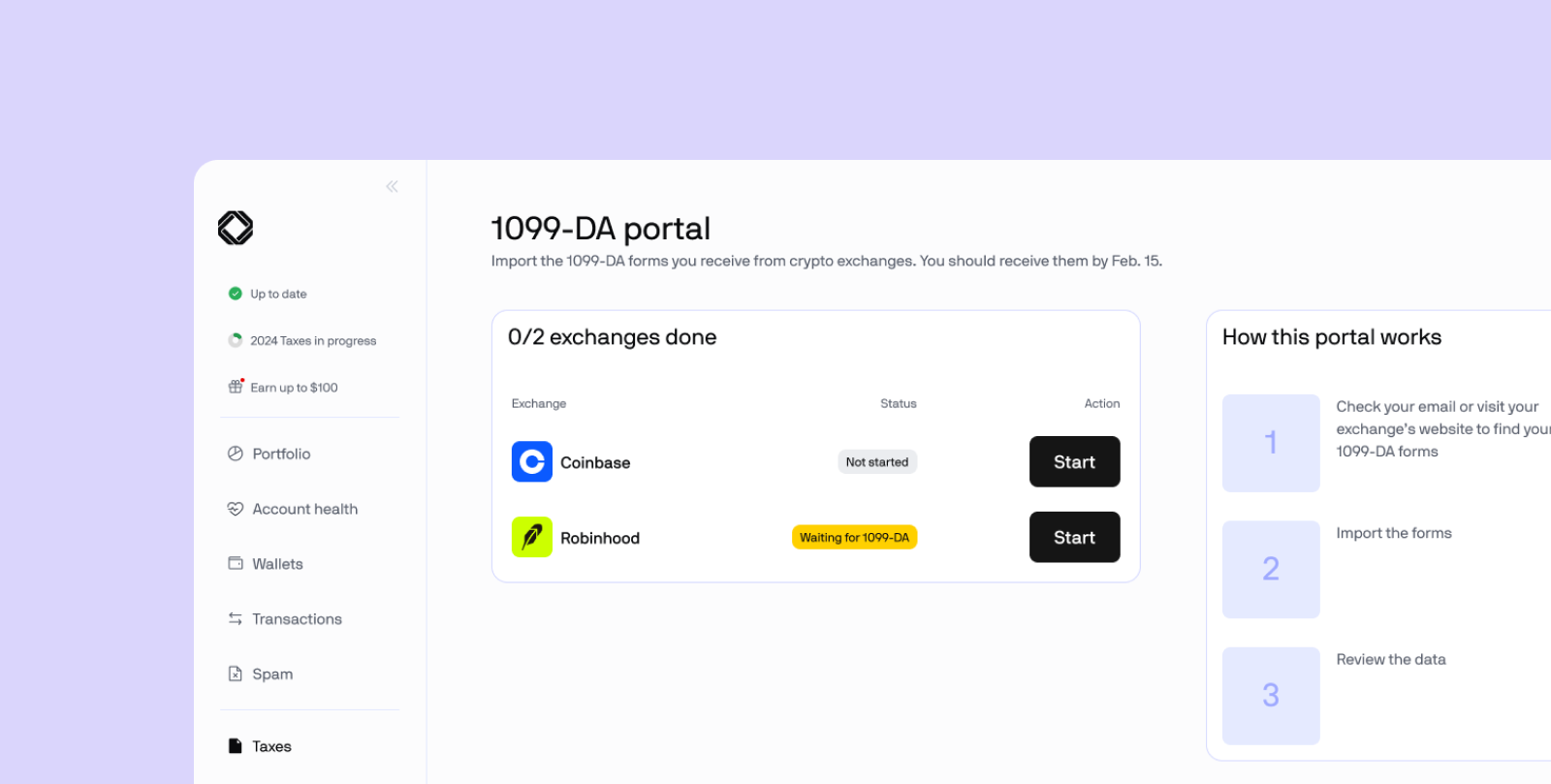

Here’s how it works:

- Ingest & match: Pull 1099-DA data alongside connected wallets and exchanges.

- Reconcile cost basis: Our upgraded transaction modeling and cost basis engine map broker-reported activity to your underlying trades and transfers.

- Flag discrepancies: Account Health highlights missing, mismatched, or suspicious data before you file.

- Export cleanly: Generate IRS-ready reports and e-file via TurboTax or H&R Block.

In short: CoinTracker takes fragmented 1099-DA data and turns it into a complete, IRS-ready tax picture, before small gaps become expensive mistakes.

What’s new at a glance

Here’s what’s new in CoinTracker this season:

- Built around 1099-DAs: Native support for 1099-DA intake and reconciliation, from ingest to export; an entirely new end-to-end tax filing journey, improved transaction and asset views, smarter EVM wallet detection, and clearer tax-year checklists on web and mobile.

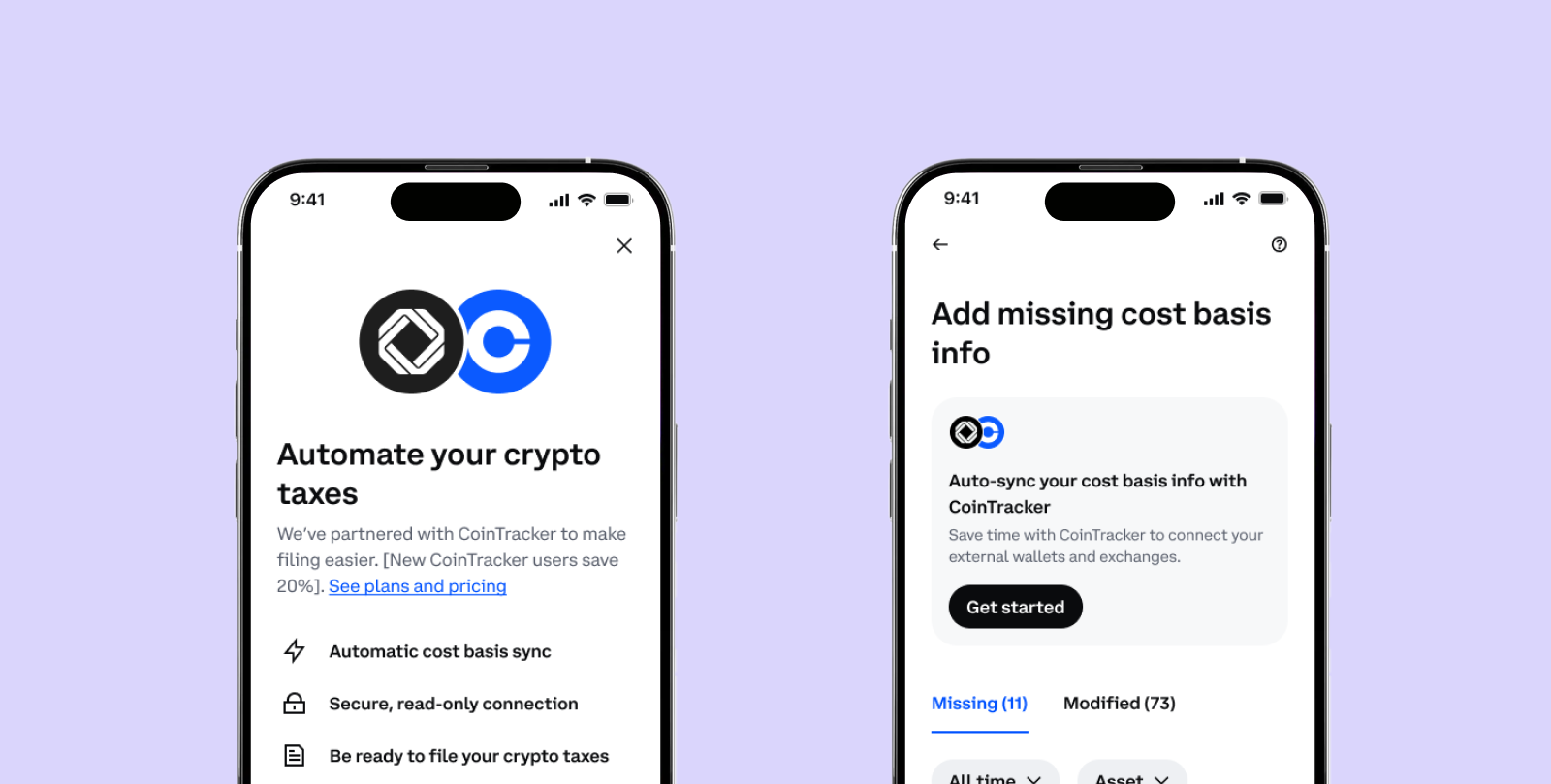

- Embedded CoinTracker: We now power native crypto taxes experiences within exchanges across the industry! Starting this season, you will begin seeing CoinTracker embedded deeper into your favorite brokers, including Coinbase. And behind the scenes, our infrastructure also supports broker-side cost basis and 1099-DA form generation at scale.

- Foundational upgrades: New cost basis infrastructure that can handle millions of transactions per user, plus smarter rules around income, staking, and complex DeFi. Plus support for new chains and exchanges, including Unichain, Monad, and Hyperliquid’s HyperEVM.

Together, these upgrades make CoinTracker the most scalable and reliable crypto tax system ever built, just in time for 1099-DAs.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

A faster, simpler, calmer UX, built around 1099-DAs

We’ve redesigned CoinTracker to feel effortless from onboarding (including 1099-DA ingestion) to final filing.

Key updates:

- Entirely new tax filing journey: Follow a guided flow that tackles high-impact issues first, surfaces transactions you might be overpaying on, and walks through 1099-DA reconciliation step-by-step — all designed to help you file faster with confidence.

- Smarter EVM onboarding: When you add an EVM wallet, CoinTracker now auto-detects which supported chains actually have activity and recommends only those, cutting clutter and setup time.

- Account Health everywhere: CoinTracker now proactively monitors your connected accounts and flags anything that could impact accuracy like sync issues or balance mismatches. You’ll see alerts right on the mobile home screen, so you can fix issues as they come up and head into tax time with fewer surprises.

- Better transactions & assets views: Faster CSV imports, improved Solana and UTXO handling, quality-of-life updates to the Transactions page, search and filters on Assets, and richer token/NFT imagery for a more legible portfolio.

Every update is designed to reduce complexity so you can file with confidence.

The infrastructure behind crypto’s tax future

This tax season, CoinTracker is powering the crypto tax experience not just for individuals — but across the industry.

From CoinTracker’s embedded tax center serving millions of Coinbase users to our Cost Basis Engine powering institutional tax compliance across 15 exchanges, our infrastructure now supports 1099-DA compliance at every level.

This is the foundation behind CoinTracker Enterprise’s Broker Tax Compliance Suite — a complete 1099-DA compliance suite trusted by top exchanges, brokers, and tax software platforms. It brings together everything needed to generate accurate forms, reconcile missing cost basis, and deliver a seamless experience to users.

Broker Tax Compliance Suite highlights:

- Embedded tax center: A native, in-platform experience that helps users complete their cost basis and access tax documents with ease.

- Broker-grade cost basis engine: Supports full historical import, tax lot tracking, and high-scale reconciliation with proven performance across millions of transactions.

- 1099-DA generation and filing: Automates compliance across federal and state levels, helping exchanges meet IRS 6045 requirements on time and at scale.

For brokers, CoinTracker is the compliance engine. For users, it’s peace of mind embedded directly into the platforms they already use.

The accuracy engine behind it all

Getting crypto taxes right means getting the details right, and CoinTracker is the only platform built with the depth, coverage, and engineering rigor to do that at scale.

Our infrastructure handles the complexity of DeFi, NFTs, and cross-chain activity at scale, ensuring unmatched accuracy for every user.

What’s new under the hood:

- New cost basis infrastructure: Our rebuilt cost basis infrastructure removes prior scalability limits and supports portfolios with millions of transactions, powering both user and broker-grade accuracy.

- DeFi coverage expansion: Added support for concentrated liquidity pools on SushiSwap and PancakeSwap, Hyperliquid funding payments, and broader DeFi position tracking including SUI staking.

- Solana & L1 upgrades: Migrated Solana to a new high-throughput backend. Rebuilt our Bitcoin, Litecoin, Cardano, and Stellar integrations for significantly better performance and correctness, especially for high-volume wallets.

- More chains, fewer gaps: Added native support for a wave of new L1s and L2s like Unichain, Monad, Berachain, Soneium, Astar, Abstract, and HyperEVM, so your tax view follows you wherever you trade.

- Global tax logic: Expanded international support with improved tax rules for Germany, Italy, Spain, and more. Includes new configuration options like classifying unmatched receives as income, where required by local law.

Whether you're a crypto investor, a tax pro, or a global exchange, CoinTracker’s foundation gives you the confidence that every detail is accounted for, and every calculated number is correct.

The 1099-DA has arrived, and we’ll have you ready

This year marks a new standard for crypto tax compliance. And CoinTracker is here to hold your hand through the murky waters.

With unparalleled accuracy, speed, and clarity, CoinTracker gives you the confidence to stay ahead of regulation, stay in control of your finances, and navigate whatever comes next.

Early bird sale is live

Kick off tax season early: new users save 20% with our annual Early Bird sale.

Every plan includes portfolio tracking, tax reports, and 1099-DA reconciliation — all in one place.