Introducing the new CoinTracker: fresh look, new features, unmatched accuracy

Jan 22, 2025・6 min read

With Bitcoin surpassing $100k and new IRS reporting requirements on the horizon, getting your crypto taxes right has never been more important. That's why we've transformed every aspect of CoinTracker — from our visual identity to our core technology — to make crypto taxes feel effortless.

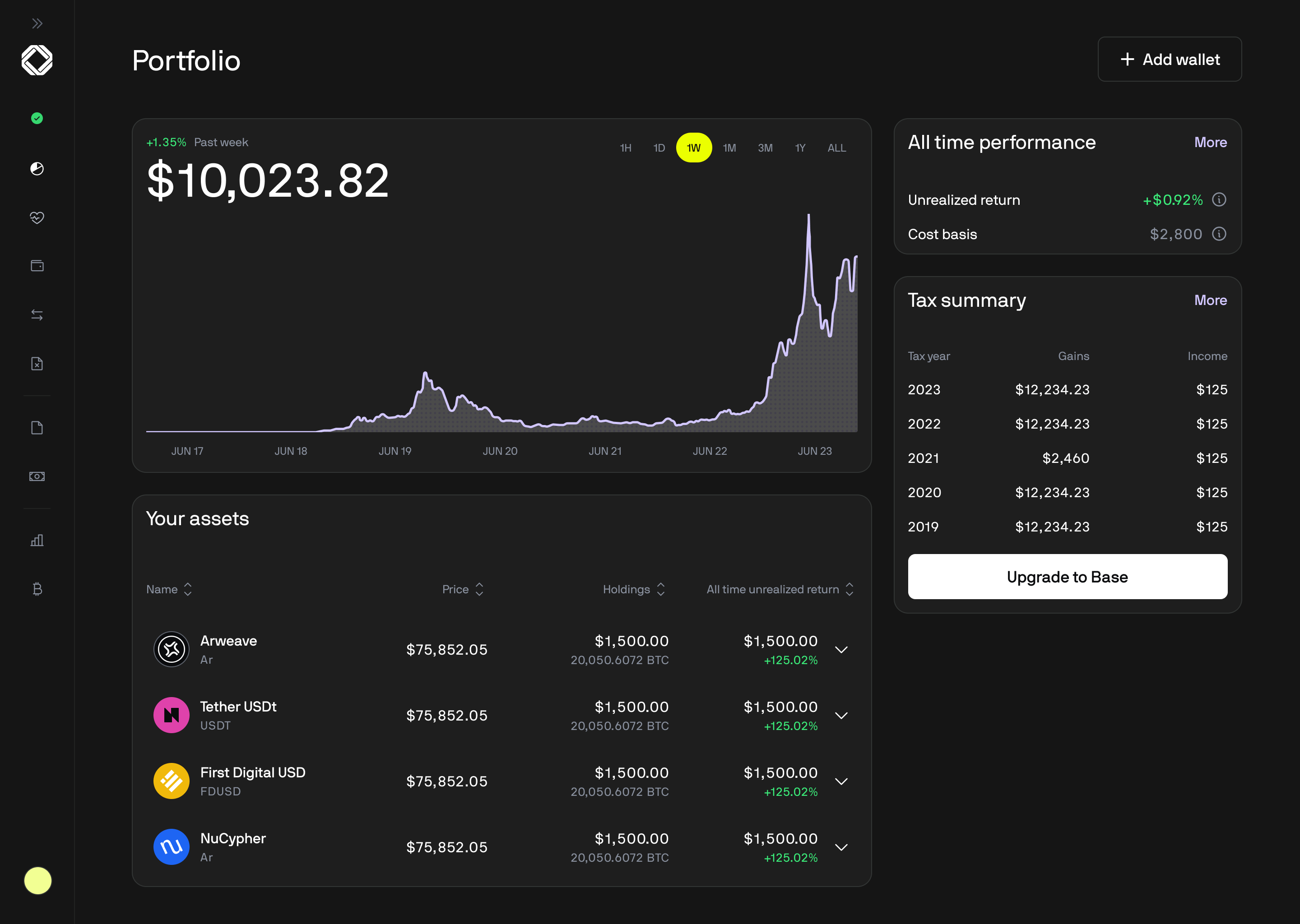

We look a little different

Filing your crypto taxes shouldn't be a grind. That's why we've rebuilt CoinTracker from the ground up — with powerful new tools, intuitive design, and streamlined navigation that make tackling your taxes a breeze. The future of crypto taxes is here.

At the beginning of 2024, we laid out the three pillars that underpin the CoinTracker product — ease of use, accuracy, and growth. This year, we added an additional pillar — speed.

Throughout the year, we rolled out a series of transformative updates across our platform that address common pain points. We’ve rebuilt everything, from our core technology to our onboarding experience, to deliver unmatched accuracy, lightning-fast results, and an experience that feels as good as it looks.

Additionally, we’ve launched two new major products. First, a Full Service CoinTracker plan to serve crypto power users, high-frequency traders, and customers looking for white glove support. Second, CoinTracker Enterprise, a cryptocurrency accounting subledger that streamlines crypto accounting for businesses using digital assets.

Today, we’re sharing those updates with you. Take a look:

A bold new brand for a bold new era

We are introducing a new visual identity — a bold, innovative, and dynamic design system that reflects the confidence, sophistication, and clarity we bring to crypto taxes.

Our transformation includes a fresh logo, color palette, typography, and entirely new UI/UX components. In building our identity from the ground up, we anchored on our north star of enabling everyone in the world to use crypto with peace of mind. From this kernel, we built an experience that puts you into a flow state, aiming to deliver tranquility (a welcome contrast to the typical stress of crypto taxes).

Our refreshed identity reflects a promise to evolve alongside crypto while ensuring every member of our community has the tools to succeed.

Effortless navigation and onboarding

We’ve reimagined how people interact with CoinTracker from start to finish. We've made it more intuitive by addressing common pain points like redundant interfaces and time-consuming workflows.

With streamlined onboarding tools that guide you through each step, getting started is easier than ever. With intuitive navigation, simplified workflows, and powerful automation, you’ll spend less time on setup and more time getting results:

- New information architecture, with a left navigation bar introduced for quicker feature access that aligns with our users’ mental models.

- A revamped Transactions page, with enhancements like bulk transfer support for tokens and NFTs and the option to hide staking rewards for a cleaner view.

- The new Account Health page proactively alerts users when their integrations fall out of sync, or other account issues need their attention.

- Improved spam detection makes it even simpler to identify unwanted tokens, helping you keep an accurate portfolio and avoid overpaying taxes.

Whether you’re new to crypto or a seasoned trader, our streamlined experience makes organizing, calculating, and filing your taxes effortless.

2025

Crypto Tax

Guide is here

CoinTracker's definitive guide to Bitcoin & crypto taxes provides everything you need to know to file your 2024 crypto taxes accurately.

The most accurate crypto tax platform in the world

Getting crypto taxes right is incredibly complex, with thousands of protocols, evolving DeFi interactions, and constantly emerging asset types. While perfect accuracy remains an industry-wide challenge, we've invested heavily in developing sophisticated calculation engines that handle the intricacies of cross-chain transactions, DeFi protocols, and emerging assets.

Our team is continuously enhancing our infrastructure to stay ahead of the rapidly evolving crypto landscape, ensuring you have the most reliable tax reporting possible.

Here’s what we’ve shipped this year:

- Expanded DeFi coverage, including smart contract wallet support and native integrations with new protocols — including Polkadot, Cronos, Linea, Blast, and zkSync Era — giving you a complete view of your DeFi activity without manual work (and more coming soon like SUI, Stacks, and Cosmos).

- Improved support for top Solana dapps, including Jupiter dollar-cost averaging (DCA), value averaging (VA), and limit orders as well as improved support for Solana staking to ensure accurate and timely tax treatment.

- Expanded price history coverage for on-chain assets and deeper pricing data for 50K+ additional tokens, including Solana, Base, and Polygon.

- 1099-DA support to ensure compliance with new regulatory changes for US users.

With an infrastructure built to handle crypto's complexity, you can trade confidently, knowing your tax calculations are precise and complete.

Faster than ever across millions of transactions

Speed matters. It’s a pain to wait for your entire portfolio to update after editing just a few transactions. So, we’ve added speed as one of our core pillars and optimized every part of our platform to deliver results faster than ever before.

- Incremental cost basis tracking and our scalable wallet syncs platform are built on a durable execution model that enables fast and reliable ingestion of millions of transactions. As a result, CoinTracker keeps your wallets up-to-date daily (and on-demand), meaning your portfolio reflects changes quickly.

- Fast transaction search ensures large accounts can find specific transactions instantly.

CoinTracker keeps you flowing at warp speed, from importing your data to managing transaction volumes to generating final tax reports. Your crypto taxes done right, without the wait.

Save money & grow your wealth

CoinTracker helps you make smarter decisions about your crypto portfolio through personalized insights and real-time tracking. Stay informed, optimize your investments, and keep more money in your pocket.

Here’s what’s new:

- More robust, actionable tax-loss harvesting (TLH): Preview your potential tax savings, understand long-term vs. short-term tax implications, and make informed decisions that put more money back in your pocket.

- Real-time portfolio insights: Track your investments with live price feeds, analyze your profit/loss across all assets, and spot opportunities as they arise.

Whether holding a few tokens or managing a complex portfolio across multiple chains, CoinTracker gives you the tools to maximize your crypto wealth.

Full Service plan launch

Our new processing abilities add custom support for the largest, most complex accounts. Our “Full Service” product provides unprecedented proactive support for the busiest crypto investors. These updates include:

- Support for 1M+ transactions and the most complex accounts.

- White glove onboarding support for exchanges and CSV files.

- Walkthrough of the entire range of CoinTracker features with a dedicated account manager.

- A direct line to your account manager so you always have an expert available to help unblock you.

CoinTracker Enterprise launch

Today, we are also excited to announce that CoinTracker is expanding to serve businesses, foundations, non-profits, and institutions with CoinTracker Enterprise, our cryptocurrency accounting subledger product.

After years of building the most accurate and robust foundation for crypto transactions, months of rigorous testing, and valuable feedback from design partners, we are excited to bring financial peace of mind to the most sophisticated institutions holding, transacting with, and investing in crypto.

Trusted by the best, built for you

When you use CoinTracker, you're joining millions of investors who trust us with their crypto taxes — from first-time traders to leading institutions. We’re proud to celebrate our fifth year of partnership with Coinbase and to be the official crypto tax partner of Intuit TurboTax and H&R Block. We continue to partner with the most trusted products in crypto, including Phantom, MetaMask, Uniswap, OpenSea, and the Solana Foundation, to enable seamless filing.

Thank you — this is just the beginning

This transformation marks more than just a visual refresh — it represents our vision for what crypto tax software should be: precise, powerful, and accessible to everyone. We're setting a new standard for what you should expect from your crypto tax platform.

As the crypto ecosystem evolves, you can rely on CoinTracker to keep you ahead of the curve, confident in your compliance, and in control of your financial future.